The Piketty bubble still shows no signs of bursting (au contraire: Chris Giles’ rather limp attempt in the Financial Times to turn it into another Reinhart-Rogoff data debacle has given it a new lease on life). Surprisingly, however, a number of rather fundamental and elementary issues have been largely overlooked or mentioned only in passing in the voluminous print and online discussion. Yet these issues bear rather crucially on what Piketty sets out to do in his book, at least in his grander ambitions going beyond the data analysis for which he is professionally known. To a certain extent they vitiate much of his analysis, yet at the same time I think they can be reassembled into a much more interesting analysis of wealth and economic growth than the rather crude one he presents (the infamous r>g).

Reassembling this Humpty Dumpty is what I plan to do in these “Nitpicking Piketty Productively” posts.

Let me start with a simple conceptual issue. Thomas Piketty’s professional core competence is in the analysis of disparate data sources to provide long-term historical overviews of household income and wealth distributions. In this, along with his colleagues Tony Atkinson, Emmanuel Saez and Gabriel Zucman, I think we can safely say we are dealing with the best authorities in an empirical area that is inherently difficult to measure, inconsistent and incomplete, and thus will always be open to debate. Nevertheless, these gentlemen must be credited with making a valiant effort to fill the gap.

It is when we start to move away from Piketty’s core competences that we increasingly encounter confusion.

The Basic Conceptual Problem

Piketty starts with the fairly well-defined notion of Private Household Wealth (PHW) but ends up conducting the analysis (as his title Capital in the Twenty-First Century pretty much compels him to do) in terms of something not coincidentally reminiscent of Marx, namely Capital. This turns out to be an exercise in bait-and-switch, as Piketty himself can not help being aware as an economist in good standing. And it leads to a completely misleading and inconsistent analysis, at the data, historical and theoretical levels. Robert Solow, in his review in the New Republic, immediately identifies this problem, which should have been obvious to anyone with a background in growth theory, but neglects to examine just how far reaching it turns out to be:

There is a small ambiguity here. Piketty uses “wealth” and “capital” as interchangeable terms. We know how to calculate the wealth of a person or an institution: you add up the value of all its assets and subtract the total of debts. (The values are market prices or, in their absence, some approximation.) The result is net worth or wealth. In English at least, this is often called a person’s or institution’s capital. But “capital” has another, not quite equivalent, meaning: it is a “factor of production,” an essential input into the production process, in the form of factories, machinery, computers, office buildings, or houses (that produce “housing services”). This meaning can diverge from “wealth.” Trivially, there are assets that have value and are part of wealth but do not produce anything: works of art, hoards of precious metals, and so forth. (Paintings hanging in a living room could be said to produce “aesthetic services,” but those are not generally counted in national income.) More significantly, stock market values, the financial counterpart of corporate productive capital, can fluctuate violently, more violently than national income. In a recession, the wealth-income ratio may fall noticeably, although the stock of productive capital, and even its expected future earning power, may have changed very little or not at all. But as long as we stick to longer-run trends, as Piketty generally does, this difficulty can safely be disregarded.

Unfortunately, this difficulty cannot be safely disregarded either in the short or the longer run because it leads to disparities on the order of seven to one in some epochs and divergent trends between the private wealth/income and “real” capital/income ratios. And it totally vitiates Piketty’s rather hapless attempt to draw on standard economic growth theory to explain these ratios. Shame on you, Bob Solow, for not seeing this (and also for using the aggregate neoclassical production function in your growth model)!

Capital vs. Wealth: What the National Accounts Say

So, how big is this disparity, and how does it evolve over time? Let’s take a quick peek using data on nonresidential capital (equipment and structures) from Maddison (1994, 2003) and on total and nonresidential fixed assets from the US government’s national accounters (Bureau of Economic Analysis—BEA):

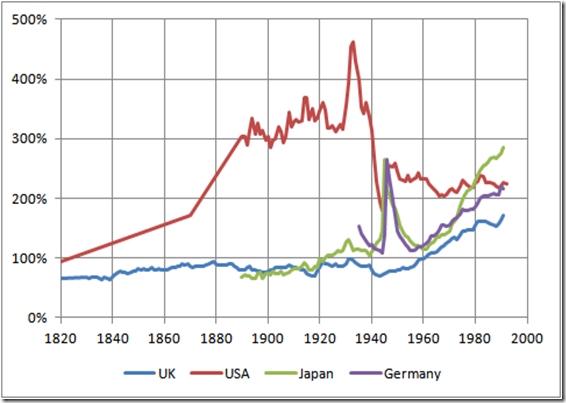

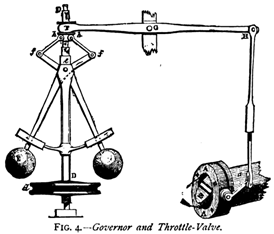

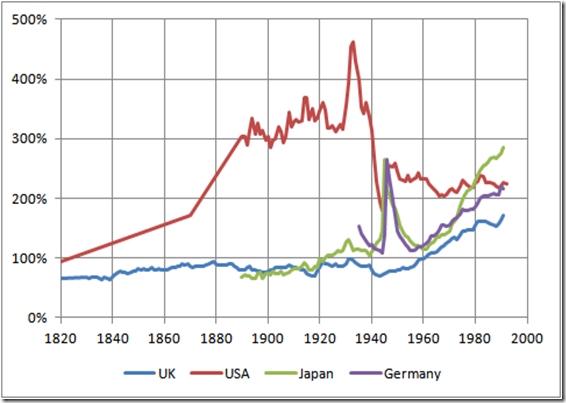

Fig. I: Nonresidential capital-output ratio for four countries (Source: for nonresidential capital stocks Maddison 1994, Maddison 2003 for pre-1890 USA,), and for GDP Maddison GDP database, all in 1990 Geary-Khemis $).

Fig. II: Capital-output ratio in the USA since 1890: 1) using Maddison (1994) nonresidential capital stock estimates and Maddison GDP database as above, 2) BEA nonresidential and 3) BEA total fixed asset estimates (including residential but excluding consumer durable) stocks at current cost, divided by BEA current $ GDP.

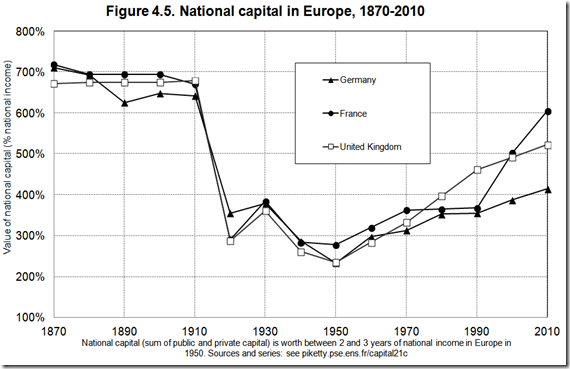

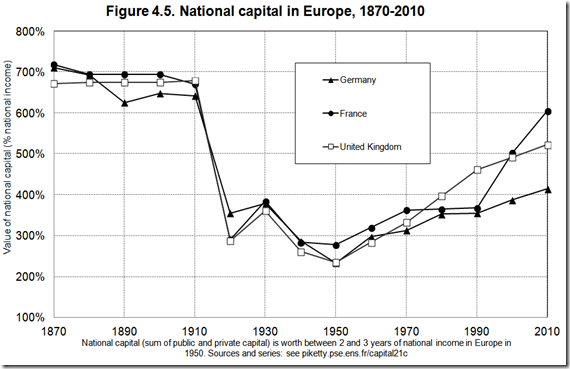

Fig. III: Piketty on the national “capital-output ratio” for Germany, France and the UK.

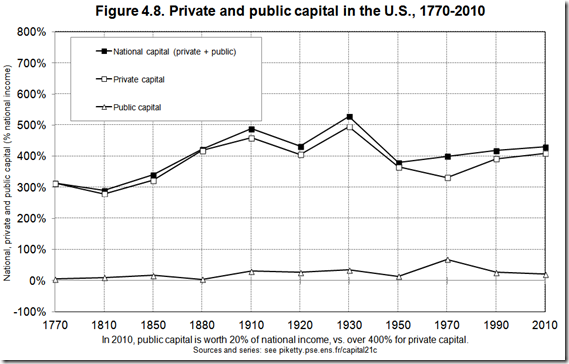

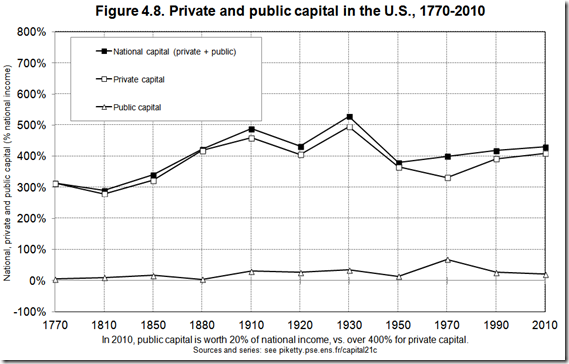

Fig. IV: Piketty on the national and private “capital-output ratio” for the US. Compare with Fig. II.

In our figures I and II capital is being measured by Maddison and the BEA using the perpetual inventory method* applied to gross investment in “real” factors of production—equipment and structures—valued at their current cost at the time of observation. Thus this represents a running account of the forsaken consumption in present prices of the accumulated and still operational investments of the past (on various, possibly questionable, assumptions about the lifetimes, mortality and depreciation rates of these different productive assets) as factors of production. What immediately stands out is that Piketty’s definition of capital for the UK is over seven times larger before 1910, and twice as large (somewhat less if we include residential assets) even for the US after 1950. In Europe, the “real” measure does not display the massive decline between 1910 and 1920 that the Piketty measure does. Moreover, while the “real” capital-output ratio has been systematically increasing after WW2 in the UK, Germany, France, and Japan, it has actually been slowly decreasing in the US from its very high value of over 300% (abstracting from the gyrations during the Great Depression and WW2 due to extreme shifts in the rate of capacity utilization) before 1930 to its present value of around 200%, with the values roughly converging internationally, as one might expect from a theory of technological catch-up. Thus the discrepancies between a national accounts, fixed assets at current costs definition of capital (what I have been calling the “real” capital-output ratio) and Piketty’s is not, as Solow suspected, only a temporary aberration, but in some periods huge and systematic.

Why is this the case? We need to go back to the basics in National Accounting to see why. Capital as defined by Piketty (which I will hereafter denote as Piketty Asset Wealth—PAW) is the net value at current market prices of all long-lived assets capable of generating a monetary return from some combination of annual profits, dividends, rents, interest, pension benefits or capital gains (price appreciation) held by private households, businesses and the state.

Let me break these assets up into seven categories:

- Real Producible Productive Capital (RPPC): real produced goods saved from current output, such as equipment and structures, that instead of being consumed are reinvested and live on for longer than a production period to aid in the production of future goods. This is the traditional definition of Capital or Fixed Assets in national accounts and growth theory: machinery and equipment, factories, infrastructure. This will show up as direct ownership of business assets, and indirectly as ownership of equities, stock mutual funds, and claims on pension funds invested in equities. A not inconsiderable part of this is not privately owned (around 15% in the USA) and thus will not show up in private PAW. At one time even slaves fell into this category, but after emancipation magically disappeared from the capital accounts and reverted to being free labor (without compensation to their former owners in the US, but with a large compensatory debt burden for emancipated serfs in Czarist Russia).

- Intangible Producible Productive Capital (IPPC): technology, knowhow, patents, intellectual property, copyrights, human capital (skills, training, education), which are also “produced” by current output, accumulated, and aid in future production but only very incompletely show up in national accounts as capital (the recent redefinition of R&D as investment will start to change this) or in personal balance sheets as wealth. They may show up in PAW in the higher market value of equities than book value (Tobin’s q), the net present value of licenses and royalties.

- Real Producible Consumption Capital (RPCC): primarily housing, whether owner occupied or rented, and durable consumer goods (cars, furniture, appliances…) . Statisticians are undecided about whether to lump this with RPPC, so they usually break these items out in fixed assets accounting. But they certainly belong in PAW to the extent that they are privately owned and traded.

- Real Nonproducible Productive Capital (RNPC): land and natural resources, to the extent that there is private tradable property in them. The value of these assets in PHW will very much be a function of tax assessment practices, accounting conventions, and the vagaries of their respective markets. These assets are factors of production (but does anyone remember when land fell out of the neoclassical production function?) but are not themselves produced—they are gifts of nature or natural capital—and thus are not accumulated from previous output due to investment. They produce income to their owners according to the Ricardian theory of rent (to the extent that there is free marginal land to define their productive contribution). In preindustrial societies this was the largest portion of wealth and is still by no means a quantité négligeable.

- The Net Credit Balance of private households of debt instruments against other households, sectors or countries (NCB): monetary assets (domestic and foreign government and corporate bonds, annuities, funded pension claims, personal IOUs, cash and bank deposits) minus monetary liabilities (outstanding mortgages, consumer loans, etc.). While this will show up negatively and positively in PAW for individual households, averaged over all sectors (household, government, corporate) and countries it will sum to zero and thus represent no net wealth at all (nor any real assets, though it may have been used to finance real asset creation)! Cash is something of an anomaly here, since it does not show up as a liability on anyone’s books, although in some sense it is just as much a component of the national debt as government bonds (and as such just “worthless” printed paper whose value is entirely socially constructed). And while some (mostly poorer) households will have negative NCBs, the private household sector as a whole will be in positive balance as the net ultimate holders of government and corporate debt. In periods of high national debt (e.g., after wars), this can represent a substantial contribution to private PAW but has no effect on “capital” at all.

- Robber Baron Capital (RBC): certain entities will sometimes be privileged with chokeholds on strategic economic activities enabling them to collect super-rents (like the original robber barons on the Rhine who could descend from their impregnable castles perched on otherwise worthless cliffs to lay a chain across the river and collect tolls from passing ships). To the extent that these privileges are salable or inheritable they become priceable wealth. I conjecture that the higher the concentration of wealth and power and the weaker the representation of the volonté générale and the greater the social disorder, the easier it will be for some individuals to establish such chokeholds at the expense of the general welfare (what economists call rent seeking). Patents are a socially sanctioned form of RBC, but otherwise most states have abrogated the right to levy internal tolls (called taxes) increasingly to themselves and abolished other royal privileges and monopolies, and by internalizing this function now have acquired an incentive to promote overall economic activity rather than be purely parasitical on it (cf. Morris 2014). The recent rise of the share of the financial services sector in some countries raises the question of whether this represents a new form of rent extraction or a return for a competitively priced legitimate service to society.

- Real Semiproducible Nonproductive Capital (RSNC): antiques, art masterpieces, precious stones and metals, classic cars, bitcoins, held primarily for their return rather than enjoyment. Things of tradable value that might once have been produced but are now in highly inelastic supply, whose value derives precisely from their verifiable uniqueness and scarcity, and whose rate of return is determined solely by capital gains (price appreciation).

Sorry to bore you will this dry stuff, but only category 1 (RPPC) is what Marx and growth theorists like Solow originally called capital subject to the laws of accumulation, and category 2 (IPPC) is what modern growth theorists would now throw in as an additional capital-like factor of production.

Typology of Asset Categories

| Asset Type | Produced | Productive | (Autocatalytically) Accumulated | Source of Returns | Depreciation |

| 1. RPPC (equipment & structures) | yes | yes | yes | factor of production | yes (wear and tear, tech. obsolescence) |

| 2. IPPC (patents, knowhow, skills, education) | yes | yes | yes | factor of production | yes (tech. obsolescence, patent expiration) |

| 3. RPCC (residential housing, consumer durables) | yes | ? (rental income would have to be imputed to owner-occupiers) | yes, but not autocatalytically | factor of consumption | yes (wear and tear, tech. obsolescence, fashion effects) |

| 4. RNPC (land, natural resources) | no | yes | no | factor of production, pure Ricardian rent | yes and no (erosion, soil exhaustion, mineral depletion, urban/infrastructure valuation externalities) |

| 5. NCB (deposits, bonds, mortgages, derivatives) | no | no | possibly | pure time preference, risk allowance | possibly (unanticipated inflation on non-indexed debt instruments) |

| 5.1 Funded pension and life insurance claims | no | no | yes | contractual claim on equity and bond funds | expires on death, heritable only to spouse/beneficiary, limited tradability |

| 6. RBC (political influence, market power) | no | no | possibly | pure superrent based on market and political power | ? (legal reforms, change of regime, expropriation) |

| 7. RSNC (art, precious metals/stones, bitcoins) | produced but irreproducible; authenticated as unique | no | yes, but not autocatalytically | pure capital gains | no except for storage costs (often a hedge against inflation) |

The theory of economic growth is based on the notion that some part of real output is saved and invested to maintain the factor of production capital and contribute physically to future production. It is not a theory of financial stocks and flows. As Keynes reminds us, the act of hoarding money is not the same thing as the act of investing real resources. Thus it only encompasses assets that satisfy all three criteria: produced, productive, and accumulated. The only assets fitting this bill are RPPC and IPPC, with RPCC (residential housing) being a marginal case. Land and natural resources, although productive factors in their own right, are neither produced nor accumulated (abstracting from land reclamation, conquest, and prospecting), and thus not capital in this sense. The income they generate is Ricardian rent. The other asset categories can certainly be income generating, and thus in a balance-sheet sense wealth, but are not capital strictly speaking in the sense of growth theory. It is the sum of (3)+4+5+6+7 that explains the gap between Maddison/BEA capital and Piketty capital. This is not to say that Piketty capital is not a valid object of study. The question is rather, whether its study is amenable to the application of the tools of growth theory. The answer, unfortunately, is no. I shall argue that asset wealth in the categories 3-7 belong to the “claimosphere,” not the “real” economy. That is, they represent marketable, legally sanctioned claims of various types on future income streams, not wealth in the sense of presently existing real factors of production (RNPC, i.e., titles to land and natural resources, being an exception). Thus their valuations and returns must be derived from a different theory than the theory of economic growth, although ultimately they must be consistent with it in the sense that these claims must be reconciled when they come due with the output that is eventually produced and the other claims on it (e.g., from labor and taxation).

ß = s/g is a Capital Mistake in the Discussion of Wealth

In Chapter 5 Piketty makes much of the Harrod-Domar steady-state growth condition ß = s/g, where ß is the capital-output ratio, s is the savings rate, and g is the rate of growth of real output (and equals the rate of growth of the labor force + the rate of labor productivity growth). This relationship is easily derivable from the national accounting identity over time and applies to any growth steady state ex post, regardless of the assumptions about savings, production functions, prices, and technological change, not only under the very restrictive assumptions Harrod and Domar originally imposed (and thus also to the canonical Solow model). But the derivation makes clear that capital only consists of “real” capital, i.e., something that is produced in the economic process, is capable of accumulation, and in turn enters into production as a production factor but lasts longer than a production period. This reduces capital to RPPC and possibly IPPC, but excludes land (RNPC) and all of the other assets enumerated above. Moreover, if we allow for the fact that “real” capital has a finite lifetime by using exponential depreciation at rate d (the perpetual inventory method national statistical agencies actually use allows for a more complex profile of capital survival and valuation differing for each asset type), then the correct formula is

ß = s/(g+d),

a discrepancy several critics of Piketty have already pointed out (e.g., James Hamilton). Moreover, this capital has to be valued in terms of the foregone contemporaneous consumption at current producer prices it represents, not expectations about its future earning capacity that determine asset values in financial markets.

Thus the Harrod-Domar condition only tells us something about the real capital-output ratio but nothing whatsoever about the Piketty Asset Wealth/output ratio (except to the extent that real capital is a component, though not always even a very large one, of historical PAW). It is completely irrelevant to the determination of PAW, as is clear when we consider agrarian societies where land is the main component of wealth but is not accumulated and produced capital, or national debt, which, while not part of national wealth, is a significant component of private wealth. What does determine PAW is a question we shall approach in subsequent posts.

Moreover, Piketty seems to implicitly regard s and g as exogenous factors determining ß, while one could perhaps more plausibly regard ß and g (not to forget d!), at least in mature economies like the US, as determined by technology, demographics, and structural change, and the savings rate, and thus the rate of investment required for steady-state full employment, as the dependent variable rather than exogenously given.

To his credit, Piketty recognizes on page 168 that the Harrod-Domar condition does not apply to nonaccumulable “capital,” i.e. land and natural resources. But it also fails to apply to nonproduced and nonproductive assets as well, which, as we descend from national wealth to private wealth to the private wealth of the 10%, 1%, 0.1% etc., become increasingly large components, as his own data show, in the form of bonds and other financial instruments, real estate, art, etc. And this discrepancy is not insignificant and not temporary due to occasional market aberrations, but systemic.

I don’t want to demean Piketty’s contribution to the debate about income and wealth inequality. But before we carefully dissect what constitutes asset income and wealth, we cannot hope to understand how it has changed over the centuries. A simple-minded invocation of the theory of economic growth à la Harrod-Domar or Solow can be very misleading way of proceeding. An additional observation will be needed to understand the various historical patterns of wealth: that the concentration of wealth is itself wealth generating—not in the sense of generating any real resources (in fact, concentrated wealth may utilize resources less efficiently), but in raising the valuation and returns of certain asset classes (land, shares, financial trading, fine art, and especially robber-baron capital) relative to the general price level and the returns of other economic activities, and thus shifting national income to capital—i.e., by pure asset bootstrapping.

* The perpetual inventory method has problems of its own that make it only a rough benchmark for estimating the capital stock. Its only input is gross investment in each year in different categories of capital goods, and various simplifying assumptions about the survival and lifetimes of these goods need to be made that are not always supported in detail by empirical studies or theories of investment behavior. Nevertheless, it represents the only consistent estimation of real capital based available since national accounts have been undertaken (the alternative censuses of machinery in which equipment and structures are directly canvased by observers have only rarely been performed).

References

A. Maddison, 1994, “Standardised Estimates of Fixed Capital Stock: A Six Country Comparison,” Research Memorandum 570 (GD-9), Groningen Growth and Development Centre (online copy. Table 7a for France is unfortunately missing from this version).

A. Maddison, 2003, “Growth Accounts, Technological Change, and the Role of Energy in Western Growth,” in Economia e Energia, secc.XIII-XVIII, Istituto Internazionale di Storia Economica “F. Datini” Prato, Le Monnier, Florence, April (online copy).

Postedit (June 29, 2014)

As a check on the surprising low values of the Maddison nonresidential capital-output ratio for the UK before WW2 (see Fig. I above) I present data from R.C.O. Matthews, C. H. Feinstein, J. C. Odling-Smee, British Economic Growth, 1856-1973, Stanford University Press, 1982, p. 133 (Table 5.4), on UK Gross Fixed Asset Accumulation 1856-1973. These estimates differ from Maddison’s by including residential housing (which we know to be on the order of 100% of GDP in the US—see Fig. II above) but neglecting depreciation (while allowing for replacement due to finite lifetimes).

While these estimates make the UK domestic fixed-asset capital-output ratio more comparable to that of the US pre-WW2, they are still about half of Piketty’s “national capital” estimates pre-WW1 for the UK, but somewhat higher than his for the period 1920-1960! (Thanks to Alessandro Nuvolari for bringing these data to my attention.)

Fig. V: UK gross domestic fixed-asset capital-output estimates 1856-1973 (including residential housing but excluding depreciation; period midpoints plotted). Source: Matthews et al.,1982, British Economic Growth, 1856-1973.